💵 📈 Understanding Compound Growth ⋆ AI of the week ⋆ Keys to courage

From understanding the compounding power of wealth growth, to exploring the latest AI breakthroughs—like a $1.3 million artwork by a robot and the arrival of Claude 3.5 Haiku—this week’s 3-in-3 also delivers five key steps to cultivate the courage needed for the journey.

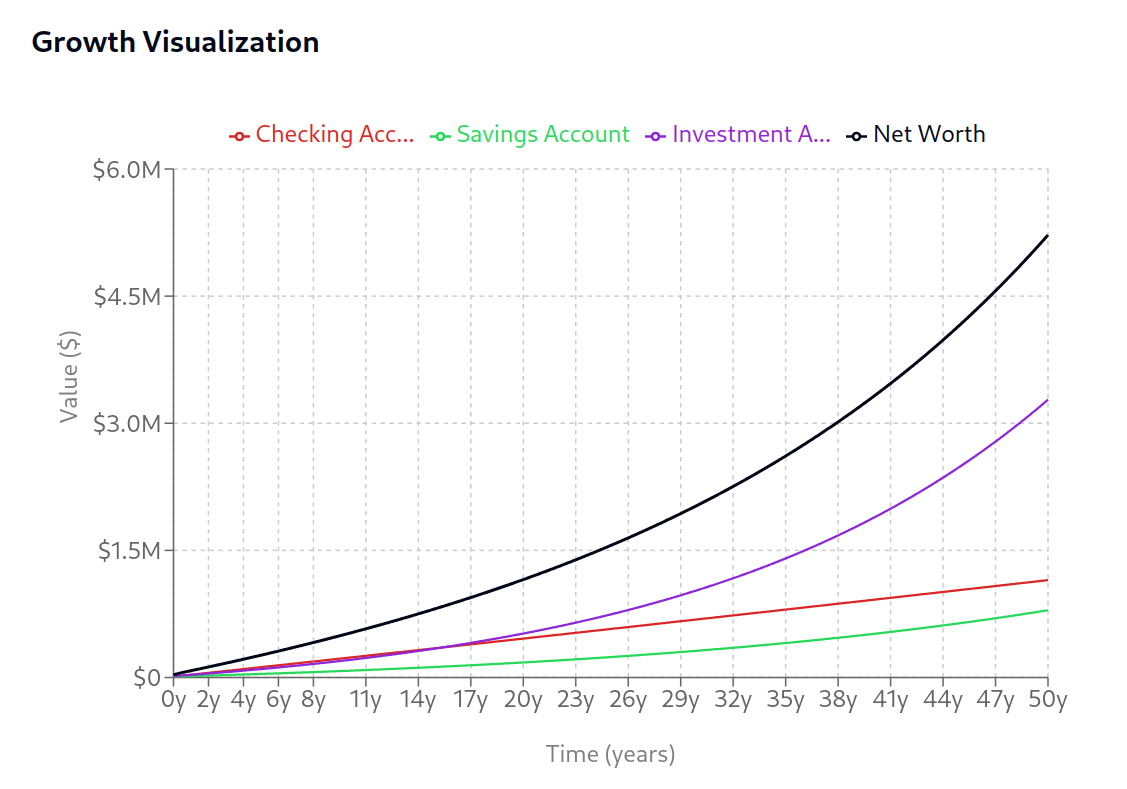

I wanted to write about this a while ago, and it would be a different post, but I wanted to make you a tool to visualize it first.

To plug your own data and see what it means for you. That's why it took longer than I wanted. And please report bugs if any 😛

As always Thing 2 covers AI news and Thing 3 brings something for personal development.

Thing 1 - Understanding Compound Growth

The math behind growing wealth is straightforward but often misunderstood. It's not just about how much you save or invest - it's about understanding how different rates of return and income streams work together over time.

It's also boring. And that's the point. It's repetitive and it just works.

Core Concepts

The basic principle is simple: your returns generate their own returns.

A 5% return on $10,000 gives you $500. Next year, you're earning 5% on $10,500. This accelerates with higher amounts, higher returns, and regular contributions.

The real impact becomes clear when comparing different approaches:

- A savings account at 0.1%: $10,000 becomes $10,100 after 10 years

- An investment account at 5%: $10,000 becomes $16,289

- Add $200 a month to that 5% investment: $49,147 after 10 years

And if you apply the interest more often, it grows even faster.

Beyond Basic Returns

Investment returns are just one piece. Building wealth often combines:

- Investment portfolio returns

- Regular savings from income

- Additional income streams (rentals, dividends, etc.)

This is when risk comes into play and things become a bit more complex. Real life is more unexpected than a projection.

When your passive income exceeds your expenses, you reach a crucial milestone: your money generates more than you spend.

Test Your Numbers

I built a tool to help visualize these concepts. It lets you model different scenarios with your own numbers:

- Compare different investment returns

- Add multiple income streams and expenses

- See the long-term impact of regular contributions

- Calculate your path to financial independence

- See when the current approach will make you exit the rat race.

The point isn't to predict exact outcomes - markets are unpredictable and past performance doesn't guarantee future returns (and this ain't financial advice, you're responsible for what you do with your money). But understanding how these mechanisms work together can help inform better financial decisions today.

The beauty of this is that it applies to every other part of your life once you see the pattern. But that's the story for another time

Thing 2 - AI of the week

Check out my latest videos, and subscribe for zero dollars.

- Artwork, created by the humanoid robot Ai-Da, depicting the renowned British mathematician and codebreaker Alan Turing was sold for ~$1.3 million at Sotheby's

- OpenAI snatched up chat.com for a hefty (rumor has it) $15 million.

- Apple rolled out the public beta for iOS 18.2, packed with new AI features. Expect more personalized experiences and improved assistance features. The ads are... tasteless? And the experience I've seen people share is 👎

Then again, it's the worst it will ever be... - Visa uses more than 500 generative artificial intelligence applications. They plan on developing "AI employees that are overseen by humans"

- Anthropic launched Claude 3.5 Haiku - fast model that's great at coding (outperforms GPT-4o on some benchmarks)

- Hume introduced the new Hume App with new assistants.

- Recraft released Graphic Design Generator

- Xpeng (Chinese EV maker - think chinese Tesla) unveiled their humanoid robot - Iron - that they've been working on for 5 years

Thing 3 - Keys to courage

the most bitter people are those who could have done something, but never did, not because they lacked intelligence, but because they lacked courage.

- Orange book

5 keys to courage:

1. Don't suffer imagined troubles

2. Focus on the smallest step you can take

3. Remember difficulty forges you into who you're meant to be

4. Do hard things (habitually)

5. It's ok to ask for help

- Daily Stoic

Till next week,

Cheers, Zvonimir